Poor

Man Survival

Self

Reliance tools for independent minded people…

ISSN

2161-5543

A Digest of Urban Survival Resources

"To lay with one hand the power of government on the property of

the citizen, and with the other to bestow it on favored individuals...is none

the less robbery because it is called taxation."

-- United States Supreme Court

-- United States Supreme Court

That Giant Sucking Sound We Hear in America is our Outdated & Unfair

Tax System…it is Killing Business & Job Creation

Of course our tax system was never intended to be like this anyway. Our Founders hated taxes, and they fought a very bitter war to escape the yoke of oppressive taxation. During his very first inaugural address, Thomas Jefferson clearly expressed what he thought about taxes…

“A wise and frugal government… shall restrain men from injuring one another, shall leave them otherwise free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned. This is the sum of good government.”

Why couldn’t we have listened to him?

When the federal income tax was originally introduced a little more than a century ago, most Americans were taxed at a rate of only 1 percent and could be done on the back of a post card. In fact, the first IRS commissioner announced to the American public that the income tax “would never affect anyone other than the top one percent of income earners!”

The Supreme Court, in the late 1890s, ruled three times against an income tax on ordinary citizens so the jerks in Congress passed an amendment to fleece the citizens.

As the

Founders of our country knew, freedom can only be securely grounded on

inalienable rights. At the very least, a free economy means the right to

liberty and property -- not as contingent or subject to government defined

duties or responsibilities -- but as absolute. But since these rights are no

longer secure in America, our economic freedom is tentative, subject to

revocation at government caprice.

The

institution of private property has been most subverted, beginning with the

income-tax amendment of 1913, which contains no legal barrier to the

government’s confiscating all American income. Only public opinion stands in

the way.

The great

libertarian Frank Chodorov called the income-tax amendment the “Revolution of

1913” that undid the “Revolution of 1789.”

Our tax system has evolved from a program of raising money to operate a bloated government and overly generous salaries and pensions of politicians and bureaucrats to a system of reward and punishment and social engineering. It’s all about control.

The poorly conceived and operated Obamacare program is a perfect example. Overly complex and riddled with glaring errors such as the lack of Tort Reform, many Americans are unable to afford premiums and several states failed to offer subsidies yet Obama uses the IRS as an enforcement arm to track and punish citizens who do not comply with his plan

It doesn’t require much mathematical skill to see how skewed and antiquated our system is and that by all rights it needs to be scrapped altogether and replaced with something along the lines of a flat tax program or national sales tax…after all, the nation managed to get along without an income tax for much of its existence.

Further, our system of taxation and regulatory nature at the state and federal level has become the great barrier to business startup, greatly curtailing our once great job creation engine –small business! The United States now ranks 13 in the world in terms of free enterprise behind Hong Kong and New Zealand!

Up until the 1960s American corporations shouldered the bulk of taxes until they managed to buy off enough politicians to shift the burden to the middle class. Eventually, most of the Fortune 500 incorporated to countries with a friendlier tax status leaving the poor schmucks on mainstreet to pick up the slack of huge government spending. [Although, based on the most recent Panama papers, certain US states now appear to have become mighty friendly to the all powerful elite].

Three quick facts about our taxes that come from the Tax Foundation…

-This year, Tax Freedom Day falls on April 24, or 114 days into the year (excluding Leap Day).

-Americans will pay $3.3 trillion in federal taxes and $1.6 trillion in state and local taxes, for a total bill of almost $5.0 trillion, or 31 percent of the nation’s income.

The Sky-High Cost of

Government

The Tax Foundation, a nonpartisan, DC-based think tank,

released their annual report earlier this month and it contained some sobering

realities about the cost of government.

They reported that, in 2016, Americans will pay over $3.3

trillion in federal taxes and $1.6 trillion in state and local taxes, for a

grand total of almost $5.0 trillion, or 31 percent of the nation’s income.

To put these numbers in perspective, here is the most

incredible revelation from their report:

“Americans will collectively spend more on taxes in 2016

than they will on food, clothing, and housing combined.”

That last statistic is a huge sore point with me.

How can anyone argue that we are not a socialist society when the government takes more of our money than we spend on food, clothing and housing combined?

What they are doing to us is deeply wrong and it is fundamentally un-American.

And of course the elite have the resources to be able to hire very expensive tax attorneys that help them manipulate the game in their favor. At the end of the day, many extremely wealthy Americans end up paying a much lower percentage of their income to the government than you or I do.

For example, just consider what the Clintons have been doing…

The Clintons and their family foundation have at least five shell companies registered to the address 1209 North Orange Street in Wilmington, Delaware — which is also home to some 280,000 other companies who use the location to take advantage of the state’s low taxes, limited disclosure requirements, and other business incentives.

Two of the five are tied to Bill and Hillary Clinton specifically. One, WJC, LLC, is used by the former president to collect his consulting fees. The other, ZFS Holdings, LLC, was used by the former secretary of state to process her $5.5 million book advance from Simon & Schuster. Three additional shell companies belong to the Clinton Foundation.

One could argue that they are simply “playing the game”, but why do we have to play such a complicated game in the first place?

Another thing that frustrates me is how our tax money is being wasted. Speaking of the Clintons, did you know that Bill Clinton still receives close to a million dollars from the federal government every year? Since he left office in 2001, he has been given approximately 16 million of our tax dollars.

Does that seem right to you?

Of course there are other examples that should make us all sick as well. Tens of millions of our tax dollars have been spent on Obama vacations.

Despite increases

in tax revenue collection and assurances from President Obama, whose past

bailouts and financial failures indicates his poor grasp of economics…the U.S.

economy is in very serious trouble. As

I indicated in an earlier report we have dozens of major retailers which are

either going bankrupt or are closing retail locations or like Ford Motor and

Nabisco [Oreo Cookies] have announced they are sending more US jobs to Mexico

while laying off US workers!

Read what Societe Generale economist Albert Edwards is saying…

A tidal wave is coming to the US economy, according to Albert Edwards, and when it crashes it’s going to throw the economy into recession.

…the profit recession facing American corporations is going to lead to a collapse in corporate credit.

“Despite risk assets enjoying a few weeks in the sun our fail-safe recession indicator has stopped flashing amber and turned to red”

…

He continued:

Whole economy profits never normally fall this deeply without a recession unfolding. And with the US corporate sector up to its eyes in debt, the one asset class to be avoided — even more so than the ridiculously overvalued equity market — is US corporate debt. The economy will surely be swept away by a tidal wave of corporate default.

Economic chaos is erupting literally all over the planet, and global leaders are starting to panic.

The dollar is collapsing, so is the global economy and the US has never recovered from its current depression. Top officials at such important banks as Citicorp have declared the US economy is in a “death spiral.”

And by the way, since fewer citizens qualify or choose to have bank accounts…

Last week, the IRS announced that taxpayers who don’t have a bank

account or credit card can now pay in cash not only at IRS offices but at more

than 7,000 participating 7-Eleven stores in 34 states.

“Taxpayers have many options to pay their tax bills by direct debit,

a check or a credit card, but this provides a new way for people who can only

pay their taxes in cash without having to travel to an IRS Taxpayer Assistance

Center," said a statement from IRS Commissioner John Koskinen.

That said, you can’t just show up and pay your tax bill along with a

Big Gulp. “There are several steps involved in the process,” USA Today

reports, “including clicking onto the IRS payment page to submit personal

information and receiving an emailed link to a payment code.

“Once they've paid, taxpayers will get a receipt and the payment

should post within two business days.”

Since our plantation masters are tightening controls on us poor serfs and tracking everything we do via the ever present and growing use of the socialist slave number [in direct violation of the Privacy Act of 1974] I always strongly urge everyone to have one or more of the following [just like the Clinton’s]:

·

A sideline

business

·

A non-profit

organization or foundation [I had/have my own private foundation but pretty

much exhausted its cash by making donations [before I had my triple bypass

heart surgery & implant] and $5,000 grants to various Veteran groups &

other charities]

·

A means of

doing business outside the banking system-cash, gold and silver, gift cards,

barter, bitcoin, etc.

Any of the above will

give you some credible and viable tax tools to work with. Remember:

Always use a qualified tax planning professional to assist you.

No matter who wins the

White House, we can count on two things as certainties: The government will

grow and “the other half” will be pissed off… taking other people’s money by force is not the “cure-all” that fixes

society’s ills. And instead, only tends to cause resentment, division and more

poverty. (A full century of failed policies should’ve proven this point, but

who cares about facts when it’s other people’s money. The failed Democrati policies in such cities

as Detroit should act as a reminder...Neither party have proven good stewards

of the public trust or our public funds.

Frankly, I no longer trust either of them.

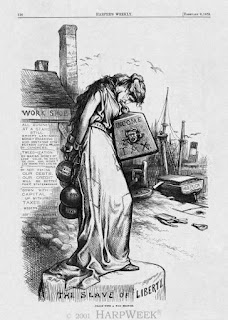

Our first tax form!

Additional Resources:

Many Americans

have decided to leave the country rather than face the ever increasing

rules and regulations, the lack of decent jobs and benefits and some of the

best opportunities according to International Living’s 2016 Global Retirement

Index include: Panama, Ecuador and Costa

Rica [many US retired military choose to live in Costa Rica where medical care,

food, housing and entertainment costs are much lower than in the USA] The cost of living in the United States continues

to rise while freedoms continue to erode…another resource to look at is…

Simon Black

Escape the Rat Race With Your Own

Home Business

>Special price for our readers: Only $5 From a program I delivered to

US veterans & others!

AMERICA — From Freedom To Fascism (Full Length

Documentary)

Is there a law which requires you to pay the Federal

Income Tax? Is the Federal Reserve a part of the United States Government, or

is it a private bank owned and operated by multinational corporate interests?

Do they have our nation's best interests at heart?

Yours for better

living,

Bruce ‘the Poor

Man’

Find a variety

of self reliance books and other items at our storefront-free shipping on

everything.

If you enjoy the

resources we present, help support our efforts by making a purchase…

Books, Art, Video – the saucy, the odd, the retro,

even the practical…

A Smoking Frog Feature, Shallow

Planet Production

1 comment:

I waste hours each year screwing around with this BS and to read how the Clintons screw us while making millions makes me seethe with anger - a pox on all those in Washington!

Post a Comment