Poor Man Survival

Self Reliance tools for

independent minded people…

ISSN

2161-5543

A Digest of Urban

Survival Resources

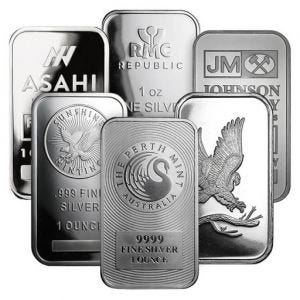

Silver strategy

FREE Survival Reports

All the excesses and corruption within government that are driving

the debt crisis are coming to the surface. Deep concern is rising among alert

Americans as well as non-Americans the world over.

The great fear is a true meltdown in public confidence. Few people

living have any idea what this means. Many more people will wake up, but most

never will. They never have.

This is why I never tire of trying to get people to keep on buying

silver with their paper money.

Do not bother asking your banker or stock broker about the wisdom

of this mindset. These people are notoriously against precious metals because

they don't sell them. They sell paper assets. They don't know anything about

silver or gold for that matter, and 99 times out of 100 they will tell you don't

buy it.

Meanwhile, watch the price of silver. No matter what the

Banksters, government or politicians do, silver will know, and its dollar price

will increase.

I usually recommend buying physical metals instead of the brokers'

metals investment products. There's a good reason why.

Most precious metals funds, such as gold ETFs and gold mining

ETFs, are based on the idea of future metal demand, not merely the metal

holdings themselves. Some are good about securing metal to represent the paper

they issue. Some are not careful at all.

It pays to carefully research precious metals ETFs to find the

ones that can unequivocally state that the shares they sell are in fact backed

by real metal in a bonded warehouse, preferably in your country of residence.

Failing that, you are much better off owning gold and silver coins and bullion

as insurance against a significant collapse in other assets, such as stocks and

bonds.

Owning mining stocks is not recommended if what you want is

security. Mining companies are highly speculative investments in any

environment and have not performed as predicted by many of the experts who

claim to closely track the industry. If you are going to buy a mining stock, do

your research and buy one or two directly — which is why I have given you

information on a few in past Alerts

— rather than through an ETF.

If you must, the largest gold metal fund is the SPDR Gold Shares

ETF (GLD) and the largest silver metal fund is iShares Silver Trust ETF (SLV).

While the largest and most liquid, you cannot go and redeem your shares for

gold unless you are a registered broker-dealer. Large hedge fund managers use

these funds, however, so it's hard to say they're not legit.

Silvery goodness

As much as we have loved buying physical silver in the past, we

love it now even more. Silver has gone lower than the $20 per ounce mark, and

isn't anywhere near the 2011 high

of $63 per ounce.

To us, silver is poised to eventually rise and attain a new floor

above $20 in the near future.

Why is silver so special? There are a number of reasons, but here

are a few:

- Because

of its malleability, ductility, conductivity and sensitivity to light,

silver has a variety of industrial, medical, decorative and monetary uses.

- In the

medical field, silver's anti-bacterial qualities are being used in a

variety of ways to prevent infections, including the “superbug” MRSA, an

antibiotic-resistant strain of staph infection that has been sweeping

through hospitals.

- Silver's

reflectivity and natural beauty make it an ideal metal for jewelry and

silverware.

- Demand

for these uses of silver has remained relatively steady in the past

decade, as newly wealthy middle-class citizens in Asia snap up silver

jewelry and silverware. In 2010 alone, silverware and jewelry accounted

for 217.3 million ounces of demand for the metal.

- While

silver has lost its luster as a metal of choice for circulating coins, its

millennia-long use as a medium of exchange makes it very sympathetic to

the movement of that most monetary of all metals: gold.

- Finally,

silver demand has exceeded silver mine production for all of the last

decade. While there is plenty of silver out there available to be melted

from scrap, the supply is not unlimited. With each passing year that scrap

and government sales are required to bridge the gap, the overall amount of

scrap supply dwindles.

You can easily buy U.S. Mint coins near your home for private

purchase. We recommend getting our exclusive Directory of Dealers Specializing in

Gold and Silver Coins and Bullion for a complete list. Please remember, prices change rapidly

— so if price checking, please do so at the same time if possible and don't

delay with your purchase to get the quoted price. Avoid "collectible"

coins and instead, focus on mint-issued products such as U.S. Gold Eagles or

Canadian Maple Leaf coins. Markup should be minimal compared to the current

price per ounce of gold.

The supply-and-demand, plus the monetary argument for silver

investing will be the forces driving the price of the metal higher.

Yours for the truth,

Bob Livingston

Editor, The Bob

Livingston Letter®

SIDEBAR

Digital Authoritarianism: AI

Surveillance Signals the Death of Privacy

Could You Give Up These 7

Expenses to Save Thousands of Dollars a Year?

You

could save more than $30,000 by setting aside these costly expenses for just

one year.

U.S. consumer confidence slid again in July

higher prices for food, gas, and just about everything else continued to weigh

on Americans. Read

More Here

America Is Intentionally Being

Destroyed by Organized Divisiveness

Special Reports – How to Survive the Coming Meltdown of

America

- Click

the links below to download your FREE Bonus Preparedness Plan Guidebook

Collection:

Bug Out

Kits-Choose Your Level

- 72-hour 4Patriot emergency food

pack [25 year shelf life

- 4Patriot Greens sample pack

[Power supplement]

- 3 Luna Nutrition bars

[assorted]+Sunmaid raisin pouch

- Cleaning Wipe Pack

- Steel River Emergency Tent

- Mini First Aid kit

- TRS 5N1 EDC folding tool

- 3-package meal sampler

- Paracord bracelet w/ compass

- Reusable Face Mask

- Personal Water Filter Straw

- 11-Piece Emergency Survival Kit

We offer several

sized kits at:

PERSONAL SURVIVAL PACK-Tried N True ‘Save-Your-Butt’ Essentials

https://www.ebay.com/itm/185325277360

https://www.ebay.com/itm/255419941572

MORE FREE Digital Reports:

- The

Water Survival Guide [Download]

- The

Survival Garden Guide [Download]

- Top

10 Items Sold Out After A Crisis - [Download]

- How

to Cut Your Grocery Bills in Half [Download]

URBAN SURVIVAL HANDBOOK

https://cdn.4patriots.com/downloads/pdf/reports/4Patriots-Ultimate-Survival-Handbook.pdf

Free enterprise, limited

government, individual freedom!

Contributors

and subscribers enable the Poor Man Survivor to post 150+ free essays annually. It is for this reason they are Heroes

and Heroines of New Media. Without your financial support, the free content

would disappear for the simple reason that I cannot keep body and soul together

on my meager book sales & ecommerce alone.

You Can’t Buy Life Insurance After You’re Dead

Not Prepared?

That's Bad News...

You Can’t Buy Life Insurance After You’re Dead-Prepare NOW for Emergencies…

Support our

efforts by shopping my storefront…

A Smoking Frog Feature, Shallow Planet Production

4 comments:

All anyone need do is look at erosion of the dollar to see the wisdom for owning silver n gold

Jam packed with useful goodies-you're the best!

Ah silver, the poor man's gold AND right now, prices are down a bit-great time to buy.

Silver's down today to about $18-good time to buy!

Post a Comment