Poor Man Survival

Self Reliance tools for

independent minded people…

ISSN

2161-5543

A Digest of Urban

Survival Resources

The Fed is taking the punch bowl away, but the

inflation crisis will continue to grow

Inflation

worse than the Carter Era

An economic earthquake

is sending destructive waves through our entire economy...

Can you feel them?

Of course you can...

Inflation is worse than it was in the 1970s. In fact, Peter

Schiff, CEO and chief global strategist of Euro Pacific Capital Inc., said he

thinks if the government measured CPI under the old formula, CPI would clock in

around 15%. ShadowStats comes up with a similar CPI estimate using 1980-based

numbers.

Four years ago, the overall sentiment among alternative and

mainstream economists was that the Federal Reserve would never hike interest

rates, taper stimulus or reduce its balance sheet into economic weakness. In

fact, this was one of the few viewpoints that the mainstream and independent

economists actually agreed on. A few of us had different ideas, though.

The argument is based on a dangerous assumption that the Fed's

goal is purely to prop up and extend the life of the U.S. economy and stock

markets. If you have been tracking equities in the Dow or the Nasdaq for the

past decade, then it might seem like a safe bet. For several years they have

consistently added stimulus or cut rates whenever stocks started to drop more than

10 percent, and this is what started the famous investor mantra "Buy The

F'ing Dip." It was a sure thing; all you had to do was buy stocks after a

correction of around 10 percent and the Fed would come in to save the day with

more inflationary QE.

However, things change, and it is foolish to assume that the Fed

actually cares about maintaining the U.S. economy. If they did care, they would

not have tried to hide the inflation threat for so long.

My position on the Fed is the same as it has always been: The

Federal Reserve is a suicide bomber. It is a useful weapon for the globalists

at the BIS, the IMF, the WEF, etc. And those globalists want a new financial

crisis so that they can implement global changes to the way money works and the

way various national economies function. They want a single global authority

and a one-world digital currency system. They want to be able to dictate all

human trade around the planet using a single mechanism.

In order to achieve these ends, they need the Fed to blow up the U.S.

economy, and that is exactly what they have done; most people just don't

realize it yet.

As I've noted previously...

"Every collectivist regime in history has used poverty and

near-starvation, or government rationing and management of production, as a

means to keep their populations under control. This is nothing new but for some

reason, many people think this strategy will never be attempted in America. They

think the establishment "needs" the American economy intact. They are

simply delusional.

When the government and the elites behind the government become

everyone’s Mommy and Daddy and the sole providers for the means of survival, it

is unlikely that the citizenry will try to rebel. That is to say, people rarely

bite the hand that feeds them.

So, central banks and their corporate and political partners

follow the Marxist model and seek to become the hand that feeds; by hook, by

crook or by financial collapse if necessary."

The only question was one of timing. When would the central

bankers try to pull the plug and allow the inflationary disaster to unfold

without hiding it any longer? Well, now we know...

As I predicted, the Fed is embarking on an active campaign to hike

interest rates by 50 bps or larger per meeting. Some members of the Fed have

sought to temper concerns by claiming that these hikes will be limited to

around 2-3 percent. This is likely a lie. The jump in the U.S. money supply and

the level of inflation I see and data tracking sites like Shadowstats.com sees indicates that

interest rates of 2 percent to 3 percent will do nothing to stop the crisis. The Fed will use

the ongoing price increases and stagflationary pressures as an excuse to

continue hiking rates well beyond that.

The money supply issue is key here because the Fed does not

acknowledge price inflation so much as they use money supply as their rationale

for policies like hiking rates into weakness.

It's not a rule, but it is certainly a habit that the Fed likes to

change the way they calculate certain economic stats whenever there is a major

crisis. They changed the way inflation was measured in the 1980s after the

near-disaster under Jimmy Carter (not his fault really, it was Nixon and the

Fed completely removing the dollar from the gold standard a few years earlier

that actually caused it). They also changed the way GDP was adjusted multiple

times, and they have changed how official unemployment is reported. In most

cases, these changes are designed to hide a

problem rather than trying to gain more accurate data.

For example, the Fed

ended its reporting of M3, which is a more accurate measure of the total money supply of

U.S. dollars circulating around the world (they claimed M2 was just as good).

This measurement was inconvenient to the Fed because inflationary policies are

ever-present and accurate reporting might cause "alarm" within the

American public. So, they simply stopped making the data available.

Maybe it's just a coincidence, but the Fed ended M3 in 2006 right

before the credit crisis of 2007/2008 began, and right before they introduced

tens of trillions of fiat dollars in bailouts and QE stimulus. One might think

they knew a

debt implosion was coming and that massive inflationary policies would be the

response...

Another

change has been made to M1 and M2 calculation (less accurate measures of U.S. money

supply), and this was done in 2020, right in the midst of the COVID pandemic

response. Strangely, this time the Fed's changes involved adding savings

deposits from smaller accounts to the overall money supply data, which means

the money supply jumped substantially.

Let me put this another way: The Fed's calculations of M1 are

integral to how they create new monetary policy. They have been calculating M1

the same for decades. Suddenly, in 2020, they changed how they calculate M1 in

a way that greatly increases

the end result, to the point that it quintuples. It is very rare for the

central bank to make data adjustments that make things look worse rather than

making things look better.

Why did they do this? I have a couple of theories.

Theory #1: In 2020 the Fed was already in the midst of one of the most

pervasive stimulus programs since the bailouts of 2008/2009. They created over

$6 trillion in new money in a single year, and that's just the official number

not accounting for overnight loans and other programs. This money was injected

directly into the general economy and into average people's accounts, as well

as into the coffers of international corporations.

It is possible the Fed changed how they calculate M1 because they

wanted to hide the true amount of dollars they were creating from thin air. If

you try to make the argument that the Fed caused our current inflationary

crisis, and you use M1 or M2 as an example of this, the central bankers can now

say "Hey, that big jump in money supply is not because of our fiat

printing, we added savings accounts to the calculation and that's why it's so high."

Of course, then you would have to believe that the money being

held in small savings accounts across the country is enough to multiply the

total money supply by 5 times. Yeah, I don't think so. To summarize, the Fed

changed its data reporting in a negative way on purpose in order to obscure the

role they are playing in the inflation disaster now unfolding.

Theory #2: The central bank wants to

raise interest rates into economic weakness without argument. So, they adjusted

the money supply calculations to be slightly more honest. Whether or not this

giant leap in M1 and M2 in 2020 is due to savings accounts being added or due

to elicit Fed printing doesn't matter. The point is, the Fed intends to jack up

interest rates and taper in the extreme while GDP and retail are in decline and

wages are becoming stagnant. It's the same thing the Fed did at the onset of

the Great Depression, which made the depression far worse than it would have

been otherwise.

That is to say, the Fed is seeking to sabotage our economy, but

they need the data to justify their actions. They need the data to more

honestly reflect the inflation threat so that they can hike rates and taper

into economic weakness while avoiding any blame for the inevitable

consequences.

In either case, the Fed's actions suggest that inflation is going

to continue unabated, and they are merely positioning themselves to deflect

blame.

The argument among independent and mainstream economists alike

will now be that the Fed will "capitulate" and reverse course on

tapering as soon as they "realize their error." Sorry, but the

central bankers are well aware of what they are doing. I suspect liberty

movement people want to believe the Fed will continue stimulus measures because

they want gold and silver market prices to go up.

Don't worry, prices will go up eventually because there is zero

chance that the Fed will stop inflation/stagflation with a 2-3 percent interest

rate hike. Also, as the economic war with the East continues to heat up,

nations like the BRICS will continue to dump the dollar as the world reserve.

The physical price of gold and silver will decouple from the manipulated paper

ETF price. It already happened in 2020-2021, and it will happen again soon.

Mainstream financial commentators want to believe the Fed will

capitulate because they desperately want the party in stock markets to

continue, but the party is over. Sure, there will be moments when the markets

rally based on nothing more than a word or two from a Fed official planting

false hopes, but this will become rare. Ultimately, the Fed has taken away the

punch bowl and it's not coming back. They have the perfect excuse to kill the

economy and kill markets in the form of a stagflationary disaster they caused. Why would

they reverse course now?

To truth and knowledge,

Brandon Smith

POSTSCRIPT

Looming

Price Hikes on Food Set to Hit Americans This Fall

Higher inflation could force Fed action, leading to a 'deeper

recession'

In its effort to contain inflation, the

Federal Reserve has launched what many expect to be an ongoing series of

interest rate increases, which are already taking a toll on stock and housing

markets, with job losses likely to follow. As weary as Americans have become

from paying record high gas and grocery prices, however, another round of price

hikes is making its way through the food supply chain and is expected to reach

consumers this fall.

“People don’t realize what’s

fixing to hit them,” said Texas farmer Lynn “Bugsy” Allen. “They think it’s

tough right now, you give it until October. Food prices are going to double.”

The 8.8

percent increase in food prices [ShadowStats.com says it’s closer to 20%] that Americans have

already seen does not take into account the dramatic cost increases that

farmers are now experiencing. This is because farmers pay their costs upfront

and only recoup them at the point of sale, months later.

“Usually, what we see on the

farm, the consumer doesn’t see for another 18 months,” said John Chester, a

Tennessee farmer of corn, wheat, and soybeans. But with the severity of these

cost increases, consumers could feel the effects much sooner, particularly if

weather becomes a factor.

What Is Your Plan To Make It Through The Worst Global Food Crisis In Any Of Our Lifetimes?

Biden has publicly admitted that the coming food shortages

are “going to be real”,

and the head of the UN World Food Program is now telling us that we could soon

see “hell on Earth” because the lack of food will be so severe. Food

prices are already escalating dramatically all over the globe, and food riots

have already erupted in Sri Lanka and elsewhere. But most people in the

western world are treating this crisis as if it is no big deal. Many seem

to assume that our leaders have everything under control and that things will

work out just fine somehow.

Unfortunately,

the truth is that everything is not going to be okay.

SIDEBAR

When disaster strikes, no one knows when things will return to

normal again. In some cases, things may never truly return to normal. With this

being the case, it’s a good idea to stock up on foods that are meant for the

long haul.

Before we begin, it’s important to note that these foods will

only last 20 or more years if they are properly stored in conditions that are

dry with stable temperatures and limited light exposure. You can learn more

about that in our list of 10 things that will destroy your food storage.

With that said, here are 20 survival foods that can last at

least 20 years...

20 Survival Foods That Will Last For 20 Years

You may also like...

14 Types of Food You Need to Stockpile

The first level of preparedness is what you have on you at all

times.

In this video Jason Salyer explains what he

carries, how he carries it, and why he chooses these items.

You’re

sure to be inspired to access your everyday gear after watching this video.

"The best time to prepare for a crash is before the crash. The biggest crash in world history is coming. The good news is the best time to get rich is during a crash. Bad news is the next crash will be a long one."

The Benefits of a Household Stockpile

If you think building a household stockpile is not worth your

time or money, think again and consider these benefits. Even if only a few

apply to you, you’ll find it is likely worth it to build your own.

Bug Out

Kits-Choose Your Level

- 72-hour 4Patriot emergency food

pack [25 year shelf life

- 4Patriot Greens sample pack

[Power supplement]

- 3 Luna Nutrition bars

[assorted]+Sunmaid raisin pouch

- Cleaning Wipe Pack

- Steel River Emergency Tent

- Mini First Aid kit

- TRS 5N1 EDC folding tool

- 3-package meal sampler

- Paracord bracelet w/ compass

- Reusable Face Mask

- Personal Water Filter Straw

- 11-Piece Emergency Survival Kit

We offer several

sized kits at:

PERSONAL SURVIVAL PACK-Tried N True ‘Save-Your-Butt’ Essentials

https://www.ebay.com/itm/185325277360

https://www.ebay.com/itm/255419941572

FREE e-books…Includes the original book by Libertarian Harry Brown’s ‘Live Free in an Unfree World.’ We had the honor of meeting him at a political function in MI before he passed away…PLUS a guide to surviving inflation!

Download at: https://1drv.ms/u/s!AgMpmQI6plfXiE2M3af5iSABRbKo?e=9eKaUr

Inflation Report: https://1drv.ms/b/s!AgMpmQI6plfXh1RsZVn1Sl-qx_kO

4 FREE Digital Reports:

- The

Water Survival Guide [Download]

- The

Survival Garden Guide [Download]

- Top

10 Items Sold Out After A Crisis - [Download]

- How

to Cut Your Grocery Bills in Half [Download]

URBAN SURVIVAL HANDBOOK

https://cdn.4patriots.com/downloads/pdf/reports/4Patriots-Ultimate-Survival-Handbook.pdf

Free enterprise, limited

government, individual freedom!

Contributors

and subscribers enable the Poor Man Survivor to post 150+ free essays annually. It is for this reason they are Heroes

and Heroines of New Media. Without your financial support, the free content

would disappear for the simple reason that I cannot keep body and soul together

on my meager book sales & ecommerce alone.

You Can’t Buy Life Insurance After You’re Dead

Not Prepared?

That's Bad News...

You Can’t Buy Life Insurance After You’re Dead-Prepare NOW for Emergencies…

Support our

efforts by shopping my storefront…

A Smoking Frog Feature, Shallow Planet Production

4 comments:

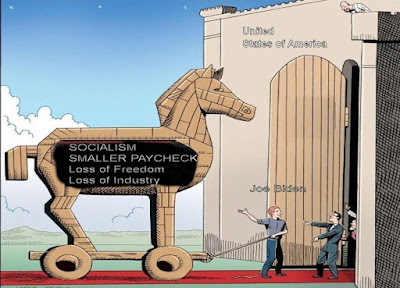

Biden is coming for your guns, your wallet & your freedom-he's part of the axis of Marxist evil!

DC IS THE DEVIL's WORKSHOP.

Wonderful thoughts-we are getting screwed by Democrats and yet, there are morons who either don't believe it or they actually support this crud!

We have the WORST crop of 'demo-rats' in office since Carter and they're movong swiftly to destroy America-make no mistake about it. It's disgusting to see how many rats are on board with our destruction.

Post a Comment